After a relaxing holiday season, the last thing most college students want to do is deal with the stressful responsibility of filing their Free Application for Federal Student Aid application for next year’s financial aid.

Yet every day after Jan. 1, when the application process opens, less and less money is available, as applications are processed on a first-come, first-served basis.

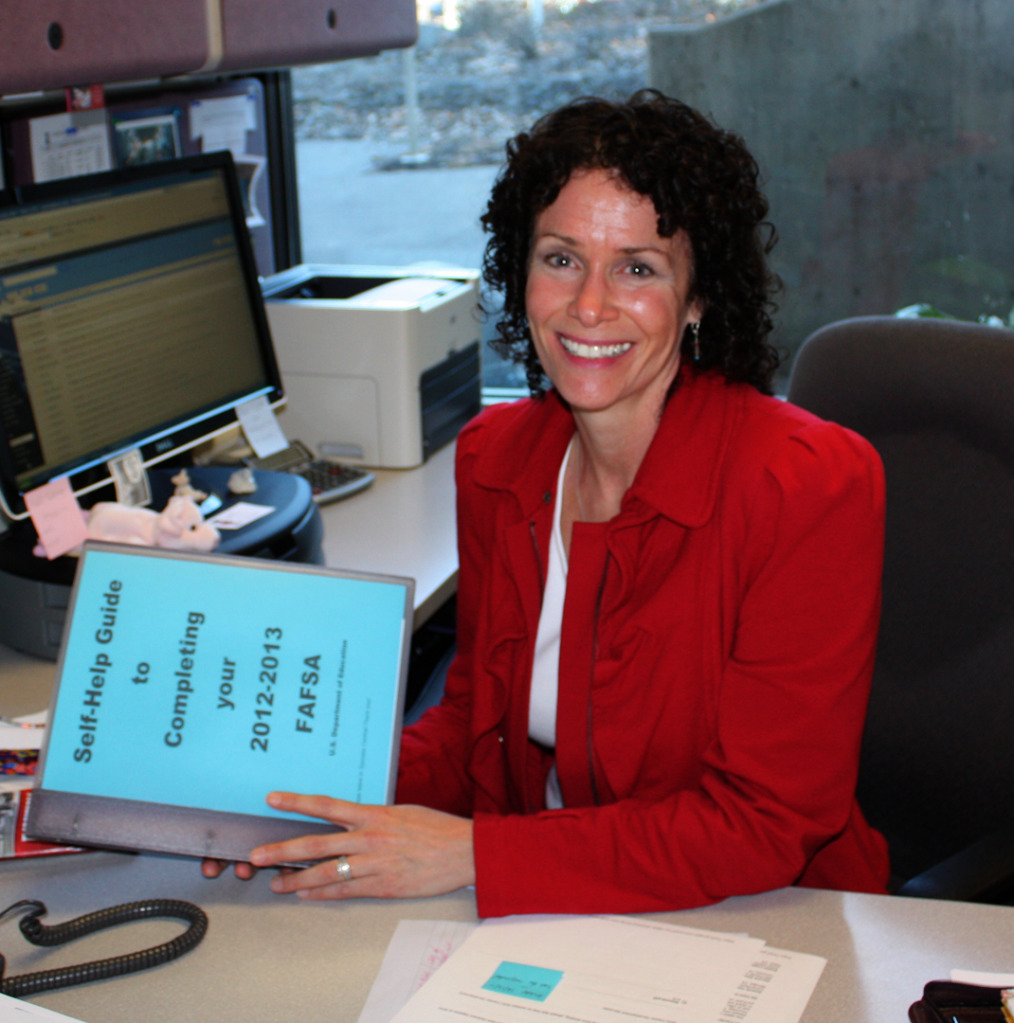

With this in mind, staff from Southern Oregon University’s Learning Commons and Success at Southern have come together to offer a workshop for students who have questions or need help filing their FAFSA on Thursday, Jan. 12 from 2:30 p.m. to 3:20 p.m. in the Academic Support Programs computer lab on the bottom floor of the Stevenson Union.

“Start early because money runs out as it did in the middle of January last year,” said Dee Perez, director of the Learning Commons. “The people offering help to the students during the workshop are all highly trained professionals that are aware of any recent changes to grants, loans or the FAFSA itself, it is a priceless resource for students.”

Completing official documents can be a new and challenging experience for freshmen or college students who have had others file for them before.

“I was initially intimidated by the process mainly because receiving my parents’ information was challenging while I was away from home and back on campus,” said Coleen Bremner, an SOU student. “The FAFSA is really simple to fill out if you can navigate a computer, the FAFSA website guides people through with tools and help that make it that much easier.”

Neither the student nor parents are required to have completed their taxes before filing their FAFSA. You are permitted to estimate you or your parents’ taxes and allowed to update the information after you receive a response about your taxes, which allows you to get a head start on filing your application.

If your parents aren’t paying for all of your college tuition and room and board, then it is possible you have loans that are accruing interest even while you are in school, unless you filled out your FAFSA early last year and met certain criteria. Both circumstances allow for an early completion of your FAFSA. A few factors that determine your eligibility for grants or loan amounts include the cost of your tuition or living expenses and family or personal income.